All Categories

Featured

Table of Contents

An additional sort of advantage credit scores your account equilibrium occasionally (each year, as an example) by setting a "high-water mark." A high-water mark is the greatest value that a financial investment fund or account has reached. After that the insurer pays a survivor benefit that's the better of the current account value or the last high-water mark.

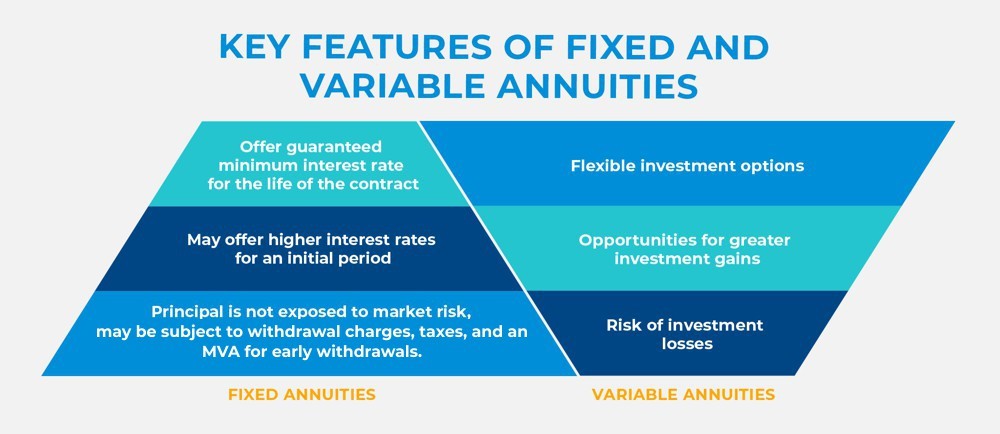

Some annuities take your first financial investment and instantly add a certain portion to that quantity yearly (3 percent, for example) as a quantity that would certainly be paid as a death benefit. Fixed vs variable annuities. Recipients after that obtain either the actual account worth or the initial investment with the yearly boost, whichever is better

You can choose an annuity that pays out for 10 years, but if you pass away prior to the 10 years is up, the staying settlements are ensured to the beneficiary. An annuity fatality benefit can be useful in some scenarios. Below are a couple of examples: By aiding to avoid the probate process, your recipients may receive funds quickly and conveniently, and the transfer is private.

Annuity Interest Rates

You can generally pick from numerous choices, and it's worth discovering all of the options. Pick an annuity that functions in the way that ideal helps you and your family members.

An annuity aids you gather cash for future earnings needs. The most ideal usage for earnings repayments from an annuity agreement is to fund your retired life.

This material is for informational or instructional purposes only and is not fiduciary investment guidance, or a protections, financial investment technique, or insurance coverage product referral. This product does rule out an individual's very own objectives or conditions which must be the basis of any financial investment choice (Guaranteed return annuities). Financial investment products may go through market and other risk variables

Who provides the most reliable Annuity Investment options?

Retirement repayments refers to the annuity earnings gotten in retired life. TIAA might share profits with TIAA Traditional Annuity owners via declared extra amounts of interest during buildup, greater initial annuity income, and via more rises in annuity earnings benefits throughout retirement.

TIAA might offer a Commitment Incentive that is only available when electing life time earnings. The amount of the perk is discretionary and identified every year. Annuity contracts may include terms for keeping them effective. We can give you with prices and full information. TIAA Standard is a fixed annuity product released through these contracts by Educators Insurance policy and Annuity Organization of America (TIAA), 730 Third Opportunity, New York, NY, 10017: Kind series including but not limited to: 1000.24; G-1000.4; IGRS-01-84-ACC; IGRSP-01-84-ACC; 6008.8. Not all contracts are offered in all states or presently released.

Converting some or every one of your financial savings to earnings benefits (described as "annuitization") is a long-term decision. As soon as revenue advantage repayments have begun, you are incapable to change to an additional choice. A variable annuity is an insurance policy agreement and consists of underlying financial investments whose value is linked to market performance.

What happens if I outlive my Fixed Vs Variable Annuities?

When you retire, you can choose to get revenue forever and/or other earnings choices. The actual estate industry goes through numerous dangers including changes in underlying building worths, expenses and income, and prospective ecological liabilities. In general, the value of the TIAA Real Estate Account will rise and fall based on the underlying worth of the direct property, real estate-related financial investments, real estate-related protections and liquid, fixed revenue investments in which it spends.

For an extra full conversation of these and various other risks, please speak with the syllabus. Liable investing incorporates Environmental Social Administration (ESG) elements that might affect exposure to companies, sectors, sectors, limiting the kind and number of financial investment chances offered, which could result in excluding financial investments that do well. There is no guarantee that a varied portfolio will boost general returns or surpass a non-diversified portfolio.

You can not spend directly in any index - Guaranteed income annuities. Various other payout alternatives are offered.

There are no charges or costs to start or stop this attribute. Nonetheless, it is essential to keep in mind that your annuity's balance will certainly be reduced by the income repayments you receive, independent of the annuity's performance. Earnings Examination Drive revenue payments are based upon the annuitization of the amount in the account, period (minimum of 10 years), and other variables picked by the individual.

Why is an Annuity Withdrawal Options important for my financial security?

Any type of warranties under annuities issued by TIAA are subject to TIAA's claims-paying capacity. Converting some or all of your cost savings to income advantages (referred to as "annuitization") is a long-term choice.

You will certainly have the option to call multiple beneficiaries and a contingent recipient (somebody designated to obtain the cash if the key recipient dies before you). If you don't name a beneficiary, the accumulated possessions can be surrendered to a banks upon your fatality. It is very important to be familiar with any monetary repercussions your recipient could face by acquiring your annuity.

Your partner could have the alternative to alter the annuity agreement to their name and end up being the brand-new annuitant (understood as a spousal extension). Non-spouse recipients can't proceed the annuity; they can just access the designated funds. Minors can't access an acquired annuity up until they transform 18. Annuity proceeds might omit somebody from getting federal government advantages - Lifetime income annuities.

What does an Annuity Interest Rates include?

In the majority of cases, upon fatality of the annuitant, annuity funds pass to an effectively called beneficiary without the hold-ups and expenses of probate. Annuities can pay survivor benefit a number of different means, depending upon terms of the agreement and when the death of the annuitant happens. The alternative chosen influences how tax obligations schedule.

Evaluating and updating your selection can help guarantee your desires are accomplished after you pass. Choosing an annuity beneficiary can be as complex as selecting an annuity to begin with. You do not require to make these complicated choices alone. When you speak to a Bankers Life insurance policy agent, Financial Agent, or Investment Advisor Agent that provides a fiduciary standard of care, you can relax assured that your decisions will assist you construct a strategy that provides security and satisfaction.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments Key Insights on Fixed Index Annuity Vs Variable Annuity What Is Annuity Fixed Vs Variable? Advantages and Disadvantages of Different Retirement P

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Defining Variable Annuity Vs Fixed Indexed Annuity Features of Annuity Fixed Vs Variable Why Choosing the Righ

Understanding Financial Strategies Everything You Need to Know About Financial Strategies What Is Annuities Fixed Vs Variable? Features of Smart Investment Choices Why Choosing the Right Financial Str

More

Latest Posts