All Categories

Featured

Table of Contents

Note, nevertheless, that this does not say anything concerning changing for inflation. On the plus side, also if you think your alternative would be to purchase the stock market for those seven years, and that you would certainly obtain a 10 percent annual return (which is much from particular, specifically in the coming decade), this $8208 a year would certainly be even more than 4 percent of the resulting nominal supply worth.

Example of a single-premium deferred annuity (with a 25-year deferment), with 4 payment choices. Politeness Charles Schwab. The monthly payment right here is highest for the "joint-life-only" option, at $1258 (164 percent greater than with the immediate annuity). The "joint-life-with-cash-refund" choice pays out just $7/month less, and warranties at the very least $100,000 will be paid out.

The way you buy the annuity will figure out the solution to that question. If you acquire an annuity with pre-tax dollars, your costs lowers your taxed income for that year. According to , getting an annuity inside a Roth strategy results in tax-free payments.

Tax-deferred Annuities

The advisor's very first step was to develop a thorough economic strategy for you, and after that describe (a) exactly how the recommended annuity matches your general plan, (b) what choices s/he taken into consideration, and (c) exactly how such alternatives would or would certainly not have actually resulted in lower or greater settlement for the consultant, and (d) why the annuity is the exceptional selection for you. - Fixed annuities

Naturally, a consultant might try pressing annuities even if they're not the most effective fit for your scenario and objectives. The factor might be as benign as it is the only item they market, so they fall target to the proverbial, "If all you have in your toolbox is a hammer, pretty quickly whatever starts appearing like a nail." While the advisor in this circumstance may not be underhanded, it increases the danger that an annuity is a poor selection for you.

How does an Fixed-term Annuities help with retirement planning?

Since annuities usually pay the representative offering them much higher commissions than what s/he would certainly receive for investing your money in common funds - Deferred annuities, allow alone the no compensations s/he 'd obtain if you buy no-load common funds, there is a big reward for representatives to press annuities, and the much more difficult the far better ()

An underhanded consultant recommends rolling that quantity into brand-new "far better" funds that simply occur to bring a 4 percent sales tons. Consent to this, and the consultant pockets $20,000 of your $500,000, and the funds aren't most likely to do far better (unless you chose also more poorly to start with). In the exact same instance, the consultant might guide you to purchase a challenging annuity with that said $500,000, one that pays him or her an 8 percent payment.

The advisor hasn't figured out how annuity payments will certainly be tired. The consultant hasn't divulged his/her settlement and/or the charges you'll be billed and/or hasn't revealed you the effect of those on your ultimate payments, and/or the settlement and/or costs are unacceptably high.

Current passion rates, and hence predicted repayments, are historically reduced. Even if an annuity is appropriate for you, do your due diligence in contrasting annuities sold by brokers vs. no-load ones marketed by the issuing business.

How do I cancel my Immediate Annuities?

The stream of monthly repayments from Social Protection is comparable to those of a deferred annuity. Given that annuities are volunteer, the individuals buying them typically self-select as having a longer-than-average life expectations.

Social Safety advantages are fully indexed to the CPI, while annuities either have no rising cost of living security or at the majority of use an established percentage annual rise that may or might not compensate for inflation completely. This type of motorcyclist, similar to anything else that raises the insurer's risk, requires you to pay more for the annuity, or accept reduced payments.

What does a basic Secure Annuities plan include?

Disclaimer: This post is meant for informational objectives only, and need to not be taken into consideration economic guidance. You should get in touch with a financial expert prior to making any major economic choices.

Since annuities are planned for retirement, taxes and charges might use. Principal Protection of Fixed Annuities.

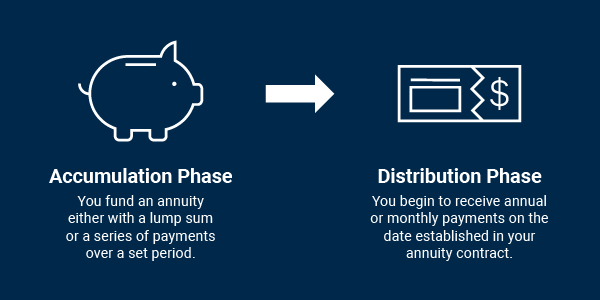

Immediate annuities. Utilized by those who want trustworthy income immediately (or within one year of acquisition). With it, you can tailor earnings to fit your requirements and produce revenue that lasts forever. Deferred annuities: For those who intend to expand their cash over time, yet are willing to defer access to the money till retired life years.

Annuity Accumulation Phase

Variable annuities: Supplies better potential for development by spending your money in investment options you select and the capacity to rebalance your profile based on your choices and in a means that straightens with transforming monetary goals. With taken care of annuities, the company spends the funds and offers a rate of interest rate to the client.

When a fatality case accompanies an annuity, it is essential to have actually a called beneficiary in the agreement. Different alternatives exist for annuity fatality benefits, depending on the agreement and insurance provider. Choosing a reimbursement or "duration certain" option in your annuity offers a survivor benefit if you pass away early.

What is the process for withdrawing from an Secure Annuities?

Naming a beneficiary besides the estate can assist this process go more smoothly, and can help guarantee that the earnings go to whoever the specific desired the cash to go to instead than undergoing probate. When present, a fatality advantage is automatically consisted of with your contract. Relying on the type of annuity you acquire, you may be able to add boosted survivor benefit and attributes, however there could be extra costs or costs related to these attachments.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments Key Insights on Fixed Index Annuity Vs Variable Annuity What Is Annuity Fixed Vs Variable? Advantages and Disadvantages of Different Retirement P

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Defining Variable Annuity Vs Fixed Indexed Annuity Features of Annuity Fixed Vs Variable Why Choosing the Righ

Understanding Financial Strategies Everything You Need to Know About Financial Strategies What Is Annuities Fixed Vs Variable? Features of Smart Investment Choices Why Choosing the Right Financial Str

More

Latest Posts